Colorado Form DR 0004: Your Guide To State Withholding Changes

Is navigating the intricacies of state tax withholding leaving you bewildered? Understanding the Colorado Employee Withholding Certificate (DR 0004) is crucial for both employees and employers to ensure accurate tax calculations and avoid potential penalties.

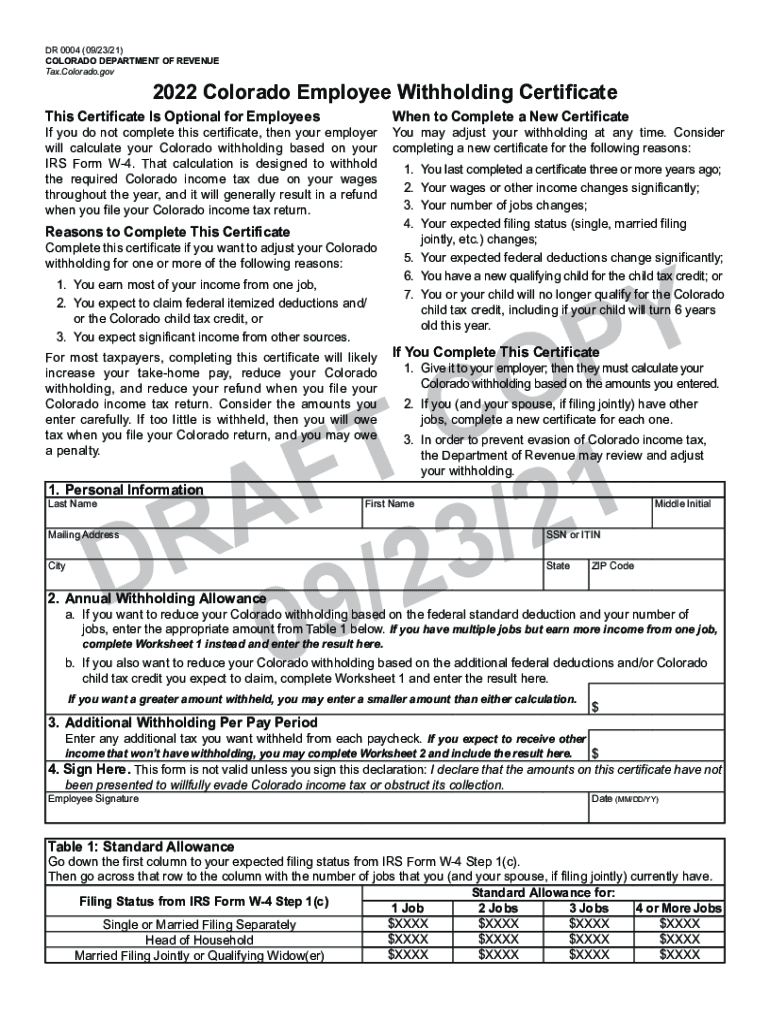

The financial landscape is constantly evolving, and staying abreast of tax regulations is paramount. For those working in Colorado, the Colorado Employee Withholding Certificate, formally known as form DR 0004, has undergone some significant updates. This document, designed to help employees adjust their state tax withholdings, plays a pivotal role in ensuring that individuals pay the correct amount of Colorado income tax throughout the year. These adjustments are often necessary to reflect changes in income, deductions, or tax credits, and accurate completion of this form is essential for compliance.

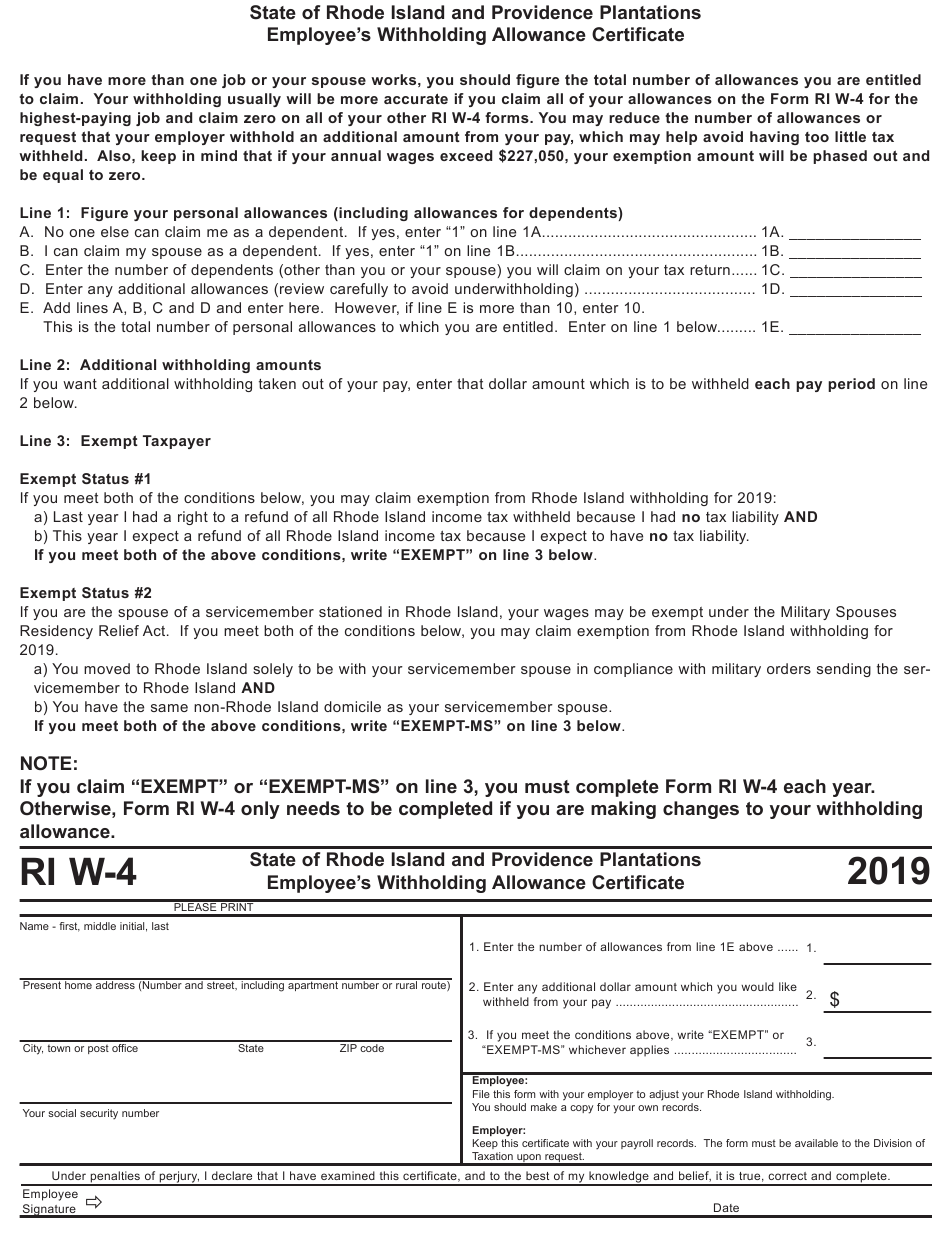

The Colorado Department of Revenue (DOR) introduced these changes, and they became effective beginning in August. The new form DR 0004 is now the only acceptable method for submitting changes to Colorado state tax withholdings. This updated form, which is optional for employees, incorporates updated formatting, higher standard allowance amounts, and a new line on worksheet 1 for accounting for additional tax credits. It's worth noting that, in addition to the federal IRS Form W-4, employees have the option to use this Colorado-specific certificate.

Heres a breakdown of what you need to know about the DR 0004 form, how it impacts the state's withholding calculation, and how employers should handle this updated process. It's designed for employees to make adjustments to their state tax withholding based on their specific financial circumstances. This form is particularly important for individuals who anticipate modifications in their income or deductions.

Lets consider the significance of the Colorado Employee Withholding Certificate (DR 0004) for individuals. This certificate empowers employees to modify their state tax withholdings based on their financial situation. The purpose is to provide employees with a means to adjust their state tax withholding as per their financial situation. The DR 0004 certificate becomes invaluable when employees anticipate adjustments to their deductions or income. This form facilitates tax planning by ensuring that employees pay the right amount of income tax and can avoid significant tax bills or penalties at the end of the tax year. The adjustments it allows help fine-tune how much Colorado state income tax is withheld from each paycheck.

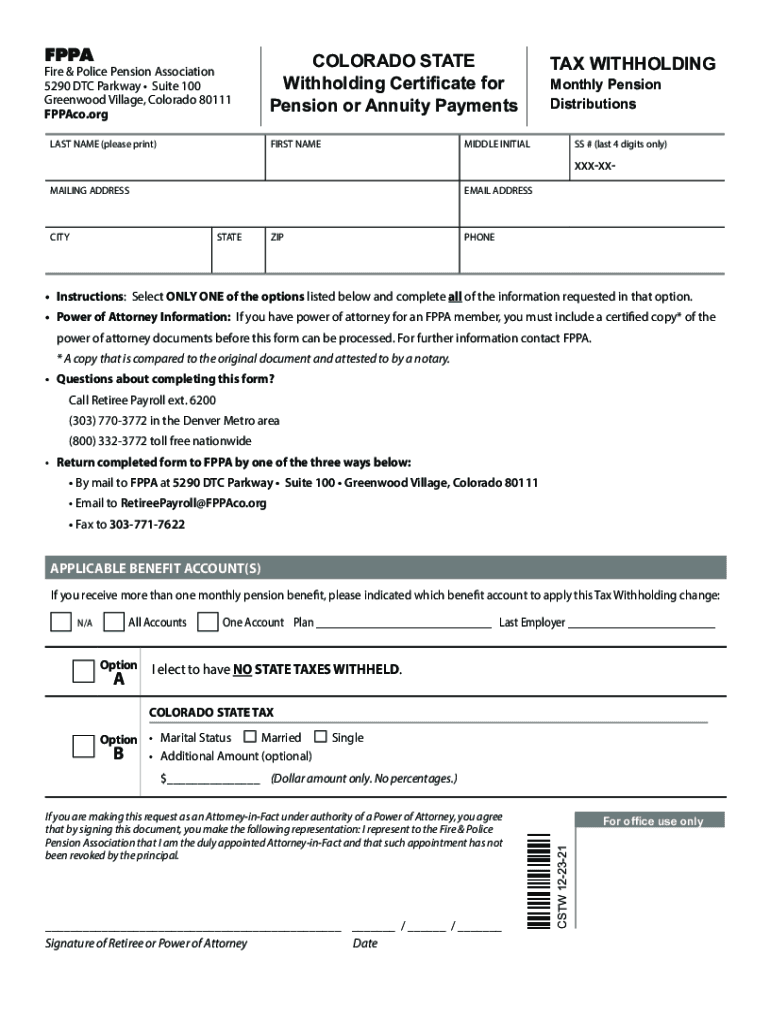

For employers, the DR 0004 demands careful attention. It is crucial for employers to recognize the updates to the Colorado employee withholding certificate and to adjust their payroll procedures accordingly. The withholding worksheet for employers (DR 1098) has been updated with instructions for including the amounts from Form DR 0004 into the current calculation steps. When employees submit a completed DR 0004, employers must calculate Colorado withholding based on the amounts entered by the employee. Failure to correctly implement these changes can lead to payroll errors, non-compliance with tax regulations, and possible repercussions from the Colorado Department of Revenue.

- Big Bear Lake Filming Locations Your Guide To Movie Sets

- The Thinning Movies Like It Where To Stream Unveiled

The new Colorado form DR 0004, is now mandatory for any modifications to Colorado state tax withholding. This underscores the importance of understanding and properly completing the form.

The DR 0004 form is essential for several reasons. This form allows employees to adjust their state tax withholding as per their financial situation. It gives employees a chance to claim allowances based on their personal situation. This helps in lowering their withholding if they qualify. The DR 0004 helps to ensure that the correct amount of state income tax is withheld from an employees paycheck. The DR 0004 helps to prevent overpayment or underpayment of taxes during the year. The updated version has increased amounts for the standard allowance, and a new line on worksheet 1 allows employees to account for additional tax credits. The DR 0004 does not replace any other federal tax forms, it is an additional form used for state taxes. It is recommended to consider the amounts entered on the form carefully.

The Colorado Department of Revenue (DOR) has released a new employee withholding certificate known as DR 0004. The form is used in tax withholding. It is a Colorado Department of Revenue form. It is a Colorado legal form, also used as an income tax form. It can be considered a legal and United States legal form. It is important for employees to give the completed DR 0004 to their employer.

Here is some more information to help understand form DR 0004 better:

- Who should use it? Employees who wish to adjust their Colorado state tax withholding.

- Why use it? To account for changes in deductions, income, or to claim Colorado tax credits.

- When to use it? Any time there are changes in financial circumstances that affect state tax liability.

- Whats new? Updated formatting, increased standard allowances, and a new line for additional tax credits.

- Where to find it? Generally available through the employer's payroll system or from the Colorado Department of Revenue's website.

The updated form DR 0004 has increased standard allowances. It also has a new line on worksheet 1 allowing employees to account for additional tax credits. The colorado withholding is based on the amounts entered on the form. If filing jointly, and you or your spouse have multiple jobs, complete a separate certificate for each job. The department of revenue may review and adjust your withholding to prevent evasion of colorado income tax. Your withholding is subject to review by the IRS.

The Colorado Department of Revenue has updated several of its withholding forms for 2025. Colorado has a new tax form available for employees to make changes to their Colorado state tax withholding. The form has updated formatting and increased amounts for the standard allowance. The employee withholding certificate form version has been updated. The form WEC year was updated from 2024 to 2025, effective January 1, 2025. The employer must calculate colorado withholding based on the amounts entered by the employee. If you have multiple jobs, complete a separate certificate for each one.

The Employee Withholding Exemption Certificate Form Version is updated. Form DR 0004 is often used in tax withholding. The purpose of the colorado employee withholding certificate is to provide employees with a means to adjust their state tax withholding as per their financial situation. The colorado employee withholding certificate is important for both employees and employers. It helps determine the correct amount of state income tax to withhold from an employee's paycheck. By filling out this form, employees can claim allowances based on their personal situation, which can lower their withholding if they qualify.

The DR 0004 is not the only form used, as there is also Form DE 4, Employees Withholding Allowance Certificate. And remember, employees are not required to complete form DR 0004. The Colorado Department of Revenue has released a new employee withholding certificate known as DR 0004. The withholding is subject to review by the IRS. If you are looking for a prior year form, please email dor_taxpayerservice@state.co.us.

When completing the DR 0004 form, it is crucial to carefully consider the amounts you enter. If you (and your spouse, if filing jointly) have multiple jobs, complete a separate certificate for each one. Give the completed certificate to your employer, who will then calculate your Colorado withholding based on the amounts you entered. It's also important to remember that the IRS may review your withholding, which underscores the importance of accuracy.

ADP is actively working to complete the development necessary to help support clients when an employee submits a DR004. Remember to not claim more in allowances than necessary or you will not have enough tax withheld.

The following table summarizes the key aspects of the Colorado Employee Withholding Certificate (DR 0004):

| Aspect | Details |

|---|---|

| Form Name | Colorado Employee Withholding Certificate |

| Form Number | DR 0004 |

| Purpose | To adjust Colorado state tax withholding. |

| Who Uses It | Employees who wish to change their state tax withholding. |

| What It Does | Allows for adjustments based on anticipated deductions, credits, and changes in income. |

| Key Features | Updated formatting, increased standard allowances, new line for additional tax credits on Worksheet 1. |

| How to Use It | Complete the form accurately and give it to your employer. |

| Employer's Role | To calculate Colorado withholding based on the information provided on the form. |

| When to Use It | Whenever there are changes that affect an individual's tax liability. |

| Related Forms | IRS Form W-4 (Federal), DR 1098 (Colorado Withholding Worksheet for Employers). |

| Important Notes | Consider amounts entered carefully; separate certificate needed for each job if multiple jobs are held. |

Remember, this form is optional. Employees are not required to complete DR 0004. Beginning in August, employees will need to use the new colorado form dr 0004, colorado employee withholding certificate, to adjust colorado state withholding tax. If you complete this certificate, give it to your employer, then they must calculate your colorado withholding based on the amounts you entered. Only the most recent version of each form is published on this page.

Detail Author:

- Name : Arianna Dooley IV

- Username : cheyanne.veum

- Email : erdman.myron@yahoo.com

- Birthdate : 2007-03-25

- Address : 9247 Else Springs Port Donnaborough, UT 23410

- Phone : 1-661-363-5557

- Company : Erdman-Conn

- Job : Pharmacy Aide

- Bio : Corrupti sit beatae dolorem illum. Eligendi rerum fugit facere placeat corporis. Impedit distinctio eius nihil. Consequatur eum vel non maiores ab.

Socials

linkedin:

- url : https://linkedin.com/in/rbeer

- username : rbeer

- bio : Voluptatem quia in numquam eum.

- followers : 5820

- following : 2828

facebook:

- url : https://facebook.com/reinhold_beer

- username : reinhold_beer

- bio : Porro nesciunt et voluptatem facere et ab.

- followers : 1319

- following : 67

tiktok:

- url : https://tiktok.com/@rbeer

- username : rbeer

- bio : Doloribus omnis magni quia laborum eaque similique.

- followers : 4381

- following : 2772

twitter:

- url : https://twitter.com/reinhold.beer

- username : reinhold.beer

- bio : Eum eaque ipsam saepe eum. Occaecati in numquam consequuntur accusamus. Rem eos doloribus quas natus.

- followers : 5926

- following : 1272