France Tax ID: Your Guide To The TIN (Numro Fiscal)

Navigating the French tax system can feel like learning a whole new language, but do you know that even if you're currently unemployed or have no income, you still need to file a tax return in France?

Welcome to France, a land of iconic landmarks, world-class cuisine, and a tax system that, while sometimes perceived as complex, is a fundamental part of daily life. For anyone residing or conducting financial transactions within the country, understanding the intricacies of the French tax identification number (TIN), known as the numro fiscal, is paramount. Whether you're a seasoned expat, a new resident, or simply someone exploring opportunities in France, this guide serves as your indispensable resource for demystifying the process.

The French TIN, or numro fiscal de rfrence (also known as the numro SPI), is a unique identifier assigned to every taxpayer. It's not just a number; it's your key to unlocking a smooth experience with French tax authorities. This number is essential for various administrative and fiscal processes, especially for filing your tax returns. You'll find it on official documents, and understanding its format and usage is critical for compliance and ensuring you fulfill your financial obligations. The TIN serves as a foundation of the French tax system, enabling the government to monitor tax payments and verify declarations, contributing to the integrity and efficiency of fiscal operations.

- Uncensored Hentai Best Forced Anime Xxx Videos Watch Now

- Unveiling Compleat Female Stage Beauty Insights Analysis

This guide will provide an insightful journey into understanding everything about the French TIN. From unraveling its structure to exploring the official databases, we will give you the practical knowledge you need to navigate the French tax landscape with confidence.

| Aspect | Details | Additional Information |

|---|---|---|

| Official Name | Numro Fiscal de Rfrence (NIF), also known as Numro d'Identification Fiscale (NIF) or SPI (Simplification des Procdures d'Imposition) | Often referred to as TIN (Tax Identification Number) in English. |

| Purpose | Unique identifier for individuals and entities within the French tax system. | Used to track tax payments, verify declarations, and facilitate interactions with the tax authorities. |

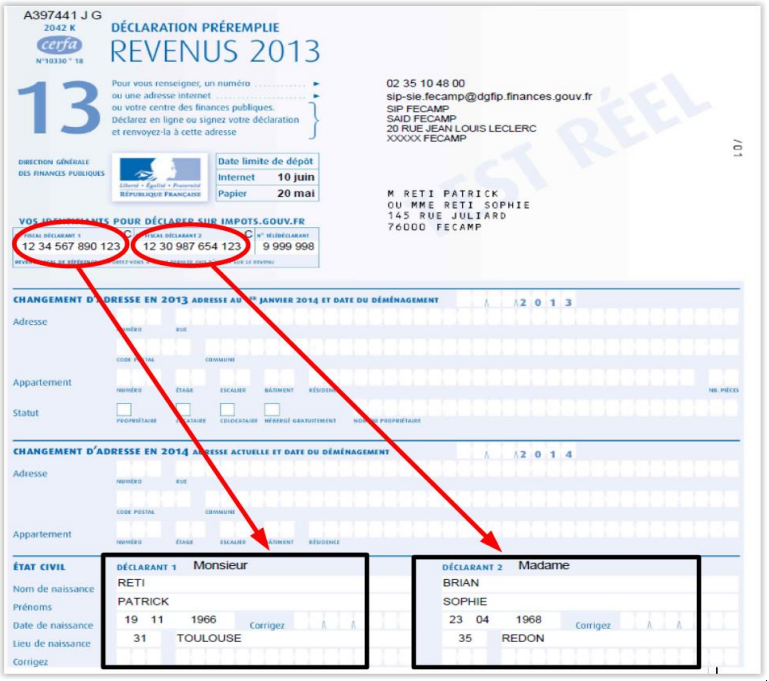

| Format for Individuals | 13 digits in the format: 99 99 999 999 999 | The first digit can be 0, 1, 2, or 3. |

| Entities | Format: The SIREN number (Systme d'Identification du Rpertoire des Entreprises) and SIRET number (Systme d'Identification du Rpertoire des Etablissements) | |

| Where to Find It | Tax return, tax notices (avis d'imposition), online tax portal (impots.gouv.fr) | Also on official correspondence from tax authorities and certain financial documents. |

| Obtaining a TIN | Automatically issued upon registration with the French tax administration for residents and often for those with an income. | May also be required for specific administrative procedures. |

| Usage | Required on various documents and for different administrative procedures. | Used in invoices, VAT declarations, and EU service declarations. |

| Importance | Essential for all tax-related procedures in France. | Failure to provide it can result in delays, penalties, or difficulties in managing tax affairs. |

| Reference | Official French Tax Website (impots.gouv.fr) | This is the official website of the French tax administration. |

The structure of the French TIN, while seemingly complex, follows a defined pattern. For individuals, the TIN is a 13-digit number. Understanding this format is critical for verifying your tax information and ensuring its correct use. The first digit of the TIN can be 0, 1, 2 or 3. This initial digit, along with the other numbers, uniquely identifies you within the French tax system.

The TIN is far more than just an arbitrary string of numbers; it is deeply embedded in the fiscal framework of France. It serves as the primary identifier for the French tax administration, enabling them to track your tax payments and declarations. It's a key component of the system that ensures every taxpayer complies with their obligations and helps in the fair distribution of the financial burden for the country.

- Watch Camilla Araujo Videos Trending Xxx Leaks Free Unlimited

- Transformers Corvette Stingray Collectibles More

The French TIN plays a crucial role in ensuring compliance with French tax regulations. The TIN serves as a unique identifier, providing a seamless way for the French tax authorities to manage tax payments and declarations. Whether you are employed, self-employed, or have other sources of income in France, your TIN is essential for paying taxes accurately and on time. It also enables the French government to streamline administrative processes, reduce fraud, and improve efficiency. The TIN is a cornerstone of the French tax administration.

The usage of the TIN extends to various aspects of your financial life in France. It is a mandatory piece of information for various official documents, including invoices, tax returns, and European service declarations (DES). When setting up a bank account, applying for government assistance, or engaging in financial transactions, your TIN is essential. Ensuring that this number is correctly recorded and readily available whenever needed will streamline your financial interactions and prevent unnecessary complications.

The TIN is not just about complying with the legal requirements; it is also about taking control of your financial affairs. By understanding where to find your TIN, you will be equipped to navigate your tax responsibilities and use your tax number with ease. Make sure you have it on hand when completing your tax returns or when engaging in various financial activities.

Minors do not possess a French TIN. However, if their parents are French tax residents, a TIN is automatically issued to them once they reach the age of 18, irrespective of their tax obligations. Upon reaching adulthood, the TIN becomes instrumental in all tax-related interactions, underscoring its significance in the administrative processes that unfold.

The French tax system demands that all taxpayers, regardless of their income, file a tax return. This requirement includes everyone. It is worth noting, even if you have no current income, you are still obliged to submit a tax return. This is a critical element of the French tax system that emphasizes compliance and contributes to the efficient administration of public finances.

The French TIN is known by different names, including numro fiscal de rfrence or numro SPI. These terms all refer to the same unique identifier used for tax purposes. This is essential for those who are engaged in any tax-related activity.

If you've misplaced your tax assessment notice ( avis d'imposition) or pre-filled tax return, but you've created a private account to pay your taxes online, the help page of the impots.gouv.fr website can guide you. By clicking the link "if you already have a private area, you can receive your tax number by email," you can quickly retrieve your numro fiscal.

As per French tax regulations, every individual subject to a tax declaration obligation receives a unique identifier. This is defined in articles 170 and the subsequent articles of the General Tax Code. This identifier is assigned upon registering as a taxpayer in the public treasury database. When you open an account on impots.gouv.fr, you will be asked to provide your TIN (Tax Identification Number). This also applies when providing your TIN to banks or enabling your French employer to carry out source deductions. These measures emphasize the TIN's importance in tax administration and ensure that tax-related transactions are correctly associated with each individual.

The European Union is encouraging the harmonization of tax identifiers among its member states. The French TIN, or numro d'identification fiscal (NIF), aligns with these broader objectives. This is a way to simplify administrative processes and to enable efficient tax compliance across the EU.

In France, the TIN is deliberately kept separate from other identification numbers such as social security numbers. This separation helps preserve privacy and supports secure data management across different government services. This is a crucial component of the system that ensures that your personal information is secure and handled with care.

The TIN allows tax authorities to track tax payments and verify tax returns effectively. It ensures tax compliance and promotes the efficient collection of tax revenue.

The official website for the French tax system is impots.gouv.fr. This website is an indispensable resource for obtaining information and assistance with your French tax obligations.

For those operating businesses in France, the TIN is also essential, but it is presented through different identifiers. In addition to the personal TIN, businesses use the SIREN (Systme d'Identification du Rpertoire des Entreprises) and SIRET (Systme d'Identification du Rpertoire des Etablissements) numbers. The SIREN number, consisting of nine digits, serves as the unique identifier for the company itself. The SIRET number, consisting of 14 digits, identifies each establishment of the company. The VAT number, is also an important identifier and consists of the prefix FR followed by two digits.

This guide has walked you through the essentials of the French TIN. By understanding its format, purpose, and usage, you're equipped to navigate the French tax system with increased confidence. Remember that the TIN is a key component of your financial footprint in France, facilitating compliance, enabling efficient tax administration, and protecting your rights as a taxpayer. With this knowledge, you are well-prepared to manage your fiscal obligations and make the most of your experiences in France.

Detail Author:

- Name : Luna Schimmel

- Username : jennyfer.goyette

- Email : carey53@prohaska.com

- Birthdate : 1984-07-10

- Address : 96761 King Cliffs Jesseburgh, VA 00168-6904

- Phone : +1 (385) 761-7942

- Company : Gerlach-Nader

- Job : Excavating Machine Operator

- Bio : Praesentium consectetur occaecati sapiente ab tempora tempore. Qui omnis in porro quia non explicabo autem.

Socials

facebook:

- url : https://facebook.com/jaqueline_id

- username : jaqueline_id

- bio : Neque itaque nihil officia est minus ea quam.

- followers : 1043

- following : 2606

twitter:

- url : https://twitter.com/jaqueline.bradtke

- username : jaqueline.bradtke

- bio : Repudiandae modi eum totam consequuntur quos est dolor. Assumenda occaecati debitis culpa dolores. Blanditiis vero hic similique ipsam et voluptates.

- followers : 6140

- following : 2543

linkedin:

- url : https://linkedin.com/in/jbradtke

- username : jbradtke

- bio : Reiciendis saepe sit quo aliquid veniam.

- followers : 1006

- following : 317

instagram:

- url : https://instagram.com/jaqueline.bradtke

- username : jaqueline.bradtke

- bio : Et vel ab magni cum voluptas. Hic omnis officia eaque autem. Quis commodi voluptas explicabo quia.

- followers : 4948

- following : 1698